Hike, Pause or Cut? Preparing for the Fed’s Next Move

The Federal Reserve took no action at its June policy meeting, but Chair Jerome Powell sent a clear message that this interest-rate-hike cycle may yet have legs.

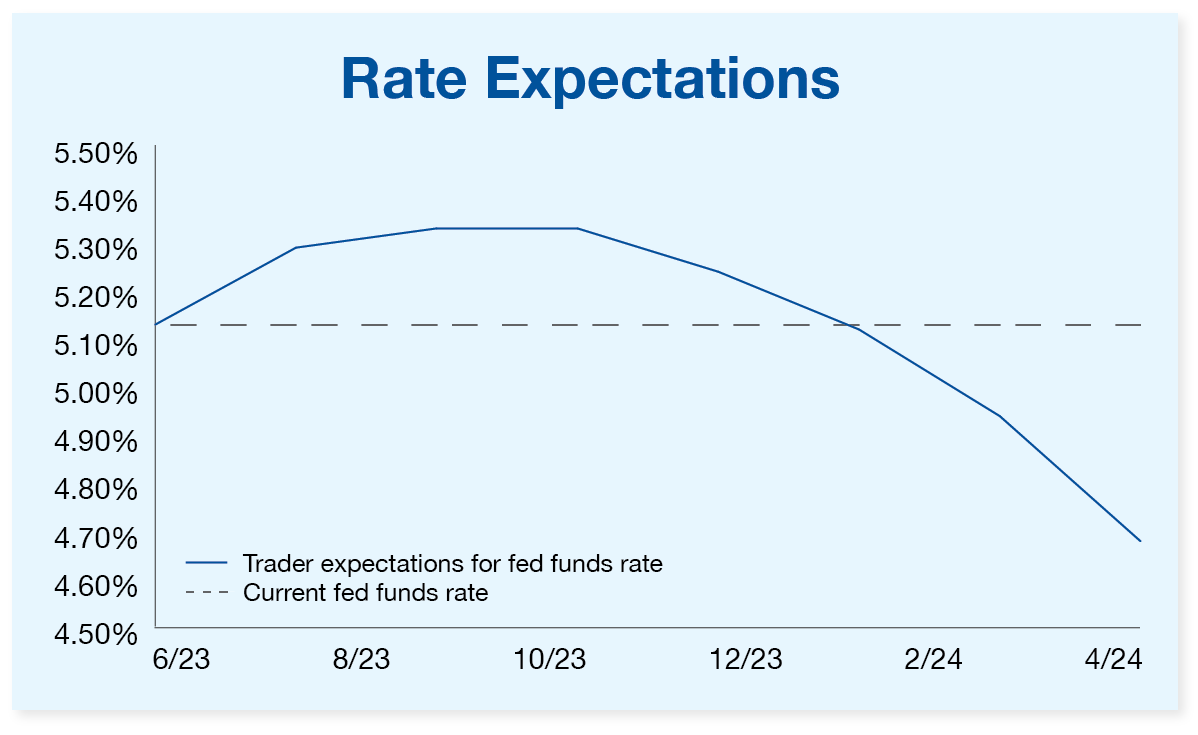

Bond traders reacted by pricing in additional rate hikes this summer. However, even as Powell signaled that cuts may be years away, the market is already betting on several policy moves to lower the fed funds rate starting this fall, which you can see in the chart below.

Note: Chart shows the midpoint of the 5.00%–5.25% current fed funds rate along with trader expectations for the fed funds rate following the June Federal Open Market Committee policy meeting as of 6/15/23 at 5 p.m. EDT. Sources: CME FedWatch Tool, Adviser.

The takeaway is that the timing of rate cuts is uncertain. Sustained inflation, economic growth and job market strength will all influence the Fed’s decision to hike, pause or even reverse course. Fortunately, time is a valuable asset in the wealth management process, and preparation is foundational to our approach.

What Happens When Rate Cuts Begin?

When the Fed does cut interest rates, it will impact many areas of your financial life from investment returns to the yield on your savings account.

Stocks and bonds. Falling interest rates are often a tailwind for bonds. When rates go lower, bond prices tend to rise. Some analysts believe the transition to rate cuts will help stock investors since inflation and aggressive Fed rate hikes were the catalyst for stock market volatility in 2022 (though, as we noted in our last update, volatility has eased in recent months).

Savings accounts. The humble savings account, money market and certificate of deposit have benefited from the Fed’s rate hikes over the last year-plus as their yields have risen from near zero to the 3% to 5% range. When rates begin to fall and cash becomes less attractive relative to the risk premium on stocks, we expect savings accounts will offer lower yields. Talk to your wealth advisor to make sure you’re getting the most out of your cash.

Be Prepared

We don’t know exactly when rate cuts will be back in the conversation. Time will tell. But we’ll be following the Fed’s policy decisions closely on your behalf, and we’ll be prepared for a range of outcomes. Call today if you have concerns or questions.

Midyear Money Moves

Interest rates are just one financial factor to consider. We’re at the midyear mark of 2023—an excellent time to reflect on some bigger-picture planning priorities that can impact your family’s wealth.

Answering these questions should come in helpful the next time you speak with your advisor:

Has your risk tolerance changed? How you feel about risk can shift as your investment time horizon changes or as your goals evolve. Maybe you’ve decided to remarry or pay for your grandkids’ college education. Midyear is an excellent time to reexamine your asset allocation, retirement savings strategy and insurance coverage. Talk to us if you’ve experienced any changes in life so we can review and update your financial plan accordingly.

What are your lifestyle priorities? Milestones such as marriage or retirement and external events like living through a global pandemic can upend life and make us rethink our priorities. Many of our clients are planning to move to a different part of the country, for example, and others are starting a business for the first time. If you are planning big changes in your own life, let’s talk about how Adviser can help.

Is it time to talk to your kids about wealth? Studies show that most couples haven’t had a candid conversation with their kids (or their parents) about their estate. Some fear that an inheritance may affect their child’s ambition. Others simply prefer to avoid discussing money. Yet transparency is an important part of estate planning, and it’s a way to bring family closer. Your advisor can help you decide when to tell your kids about your trusts, living will, business succession strategy and the details of your estate plan.

What other midyear money moves should you make? June is also a good time to take stock of your income and tax withholdings. Small adjustments now can mean no surprise tax bills come April. And you can plan for actions you’ll take later in the year—including a Roth IRA conversion or potential tax-loss harvesting. If you must take required minimum distributions (RMDs), prepare to take them by year-end.

With these questions answered, all that remains is to enjoy your summer vacation. Please let us know where you decide to go and send us a photo!

Adviser Market Update

Here are some of the other items our research team is watching and why they matter:

Federal Reserve Chair Jerome Powell appeared on Capitol Hill this week for scheduled congressional testimony. Referencing strength in both employment and the economy, Powell implied that the central bank’s latest decision is a skip, not a pause. The decision to keep rates the same marks a change in the pace of tightening (or borrowing conditions) in the economy, but not the end of it.

Major factors in the Fed’s decision to hold steady? The consumer price index rose 4% in May compared to a year earlier, down significantly from the 9.1% peak last June. Another positive development is the drop in apartment rents, falling to 2% annualized from double-digit growth a year ago. Energy prices also continue to decrease. While inflation remains above the Fed’s stated 2% target rate, we’re pleased to see progress.

The steep climb in borrowing costs hasn’t extinguished Americans’ ability to spend. Consumer sentiment reached a four-month high in May, which bodes well for spending in the months ahead. Retail sales rose unexpectedly in May, even after April’s strong gains—there’s no better way to forestall a recession than consumers putting their wages to work in support of the economy.

Strategy Activity Update

Please see below for a summary of the trades we executed over the week through Thursday and our current tactical strategy allocations.

Dividend Income

No trades

AIQ Tactical Global Growth

No trades

AIQ Tactical Defensive Growth

No trades

AIQ Tactical Multi-Asset Income

Sell Invesco DB US Dollar Index Bullish Fund (UUP)

Buy Invesco DB Agriculture Fund (DBA)

AIQ Tactical High Income

No trades

If you’d like to learn more about our tactical or fundamental strategies, please contact Steve Johnson at 844-587-7393 or info@advisercapital.com.

Please note: This update was prepared on Thursday, June 22, 2023 prior to the market’s close.

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Purchases and sales of securities listed above represent all securities bought and sold in each strategy during the period stated. Each strategy’s portfolio generally includes more holdings in addition to the transactions listed above and in some cases the securities listed above may only represent a small portion of the particular strategy’s complete portfolio. Further, the securities listed above are not selected for listing based on their investment performance; thus it should not be assumed that any of the securities listed above were profitable or will be profitable, nor should it be assumed that future recommendations will be profitable. Clients and prospective clients should only make judgements about a strategy’s performance after reviewing the strategy’s composite performance information. There is no assurance that each security listed above will remain in the strategy’s portfolio by the time you have received or read this email. Securities are listed for informational purposes and are not intended as recommendations. Existing investor accounts may not participate in all transactions listed above due to each account’s particular circumstances.

Our statements and opinions are subject to change without notice and should be considered only as part of a diversified portfolio. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with Adviser Investments Tax Solutions. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

Third-party publications referenced in this article (e.g., Citywire, Barron’s, InvestmentNews, CNBC, etc.) are independent of Adviser Investments. Readers should note that to the extent any third-party publication linked to in this piece also contains reference to any of the newsletters written by Dan Wiener or Jim Lowell, such references only pertain to the respective newsletter(s) and are not reflective of Adviser Investments’ investment recommendations or portfolio performance. Newsletters are operated independently of Adviser Investments. Opinions and statements contained in third-party articles are for informational purposes only; they are not investment recommendations.

The Adviser You Can Talk To Podcast is a registered trademark of Adviser Investments, LLC.

The Adviser Capital logo is a registered trademark of Adviser Investments, LLC.

© 2023 Adviser Capital, an Adviser Investments, LLC company. All Rights Reserved.