Spring Cleaning for Your Finances

Financial Planning in Your Prime

Strategy Activity Update

Market & Economy Snapshot

Spring Cleaning for Your Finances

Spring cleaning makes your home feel lighter and brighter heading into the summer. But why stop there? You can lighten your emotional load by putting your finances in order, freeing you up to focus on sunscreen and summer travel. Start with these simple suggestions.

Organize your income and expenses. Spending patterns shifted for all of us during the pandemic. Your income may have changed over the last few years due to a new job or a salary adjustment, too. With travel and entertainment back to pre-pandemic levels, now is a great moment to scrub your budget. We recommend periodically reviewing your income and expenses to make sure your personal balance sheet is on track.

Straighten out beneficiaries. Did you know that the beneficiaries listed on your retirement plans, life insurance policies, annuities and other accounts supersede what’s specified in your will? It takes only a few minutes to make sure your beneficiaries are correct on your accounts—while you’re at it, make sure your contingent beneficiaries are updated as well. This is the type of thing that will help give you and your family peace of mind.

Spruce up insurance coverage. If it’s been a few years since you’ve looked at your insurance coverage, it may be time for a refresh. Start with the basics: Life, disability, home and auto, and umbrella liability. Insurance needs change when milestones come along, whether that means getting married, buying a new home or selling your business. Each of these life events is a catalyst for reviewing your insurance to make sure you’re sufficiently covered.

Refresh tax withholdings. Tax season is in its eleventh hour, making now an ideal time to scrutinize your withholdings. While it feels nice to get a refund check from the IRS, this isn’t always the most efficient way to manage your cash flow—and the government thanks you for your interest-free loan! If you suspect you may be withholding too much or too little, let’s check in. Or you can use the IRS’ online tax withholding estimator. We recommend the $500 rule of thumb: If you owe or are refunded more than that, it’s time to tweak your withholding.

Clean up your accounts. Odds are you haven’t spent your entire career with one employer—meaning you may have retirement funds stashed in several 401(k)s or other accounts. Leaving funds forgotten in ancient accounts often means they’re part of a stale investment strategy that’s no longer suitable for your goals. In some cases, rolling the funds into an IRA might lower your costs and improve your returns; in others, it may be preferable to consolidate into one 401(k).

Once you’ve run through this list, your financial picture will be in even sunnier shape.

Financial Planning in Your Prime

With inflation concerns so persistent, financial planning is more important than ever—but no two plans are the same. That’s why we take a holistic tack to tailor financial plans to meet your specific needs. With that in mind, we’ve covered a variety of considerations based on life stages that may apply to you. You can find some of our advice in the following financial planning blog posts:

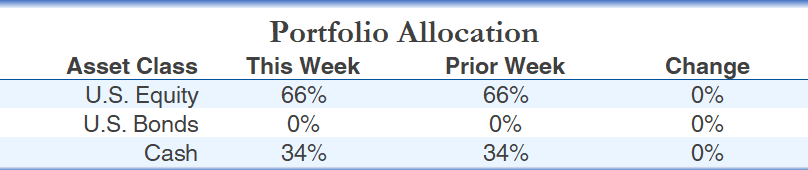

Strategy Activity Update

Please see below for a summary of the trades we executed over the week through Thursday and our current tactical strategy allocations.

Dividend Income

No trades

AIQ Tactical Global Growth

Sell VanEck Semiconductor ETF (SMH)

Buy iShares Expanded Tech-Software Sector ETF (IGV)

AIQ Tactical Defensive Growth

No trades

AIQ Tactical Multi-Asset Income

No trades

AIQ Tactical High Income

No trades

If you’d like to learn more about our tactical or fundamental strategies, please contact Steve Johnson at 844-587-7393 or info@advisercapital.com.

Please note: This update was prepared on Thursday, April 13, 2023 prior to the market’s close.

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Purchases and sales of securities listed above represent all securities bought and sold in each strategy during the period stated. Each strategy’s portfolio generally includes more holdings in addition to the transactions listed above and in some cases the securities listed above may only represent a small portion of the particular strategy’s complete portfolio. Further, the securities listed above are not selected for listing based on their investment performance; thus it should not be assumed that any of the securities listed above were profitable or will be profitable, nor should it be assumed that future recommendations will be profitable. Clients and prospective clients should only make judgements about a strategy’s performance after reviewing the strategy’s composite performance information. There is no assurance that each security listed above will remain in the strategy’s portfolio by the time you have received or read this email. Securities are listed for informational purposes and are not intended as recommendations. Existing investor accounts may not participate in all transactions listed above due to each account’s particular circumstances.

Our statements and opinions are subject to change without notice and should be considered only as part of a diversified portfolio. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with Adviser Investments Tax Solutions. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

Third-party publications referenced in this article (e.g., Citywire, Barron’s, InvestmentNews, CNBC, etc.) are independent of Adviser Investments. Readers should note that to the extent any third-party publication linked to in this piece also contains reference to any of the newsletters written by Dan Wiener or Jim Lowell, such references only pertain to the respective newsletter(s) and are not reflective of Adviser Investments’ investment recommendations or portfolio performance. Newsletters are operated independently of Adviser Investments. Opinions and statements contained in third-party articles are for informational purposes only; they are not investment recommendations.

The Adviser You Can Talk To Podcast is a registered trademark of Adviser Investments, LLC.

The Adviser Capital logo is a registered trademark of Adviser Investments, LLC.

© 2023 Adviser Capital, an Adviser Investments, LLC company. All Rights Reserved.