Tax Season—We’re Just Getting Started

Is Social Security Secure?

Strategy Activity Update

Market & Economy Snapshot

Tax Season—We’re Just Getting Started

Tuesday marked the deadline to file your tax returns for 2022, unless your state granted an extension. And yet—that doesn't mean we’re not thinking about tax strategy—in many ways, tax planning season is just kicking off for us.

Charitable planning: If you have goals for giving, we can walk you through which type of charitable donations provide the greatest overall tax efficiency. For example:

Let’s discuss how to make qualified charitable distributions (QCDs) from your IRA—they are excluded from your taxable income and you don’t need to itemize them when you file your tax return.

If you are giving stock, long-term appreciated equities are the most tax efficient—the more appreciated the better.

From a tax-efficiency perspective, keep in mind that giving cash is the most “expensive” way you can donate or pass along wealth.

Family gifting: Giving money to your loved ones can be an excellent way to set them up for financial success. But remember, the IRS puts a ceiling on how much you can gift untaxed. (In 2023, the gift tax exclusion is $16,000 per person per year for individuals or $32,000 if you file jointly with a spouse.) But we can help you gift above the limit by earmarking funds for the education or medical expenses of family members.

Roth conversions: If you anticipate a low-income year due to early retirement or some other reason, it may make sense to take the opportunity to convert. This strategy can be especially effective if you’ve elected to defer Social Security benefits to age 70—dropping your tax rate even further. The longer you have before you need the money, the more sense it makes to convert assets to a Roth. Once you convert, qualified withdrawals will never be taxed. Leaving those assets untouched for as long as possible allows them to grow tax-free over time. This will squeeze the most juice out of the conversion.

There’s a lot more to cover—but that’s enough tax talk for today. Please reach out so we can continue the conversation.

Is Social Security Secure?

As with tax strategy, we’ve also got you covered on Social Security concerns…

You may have seen the news that the Social Security fund is projected to be depleted one year earlier than expected…again. It’s become an annual tradition to hear that Social Security is in danger of default.

That said, we understand the concern and we’ve certainly received questions from clients: Will my Social Security benefit be reduced? Should I file early to make sure I receive benefits? In fact, a survey from Transamerica found that 70% of workers lose sleep over Social Security's solvency, or lack thereof.

Our quick response? Social Security shouldn't keep you up at night.

The first thing to know is that Congress has a simple means to solve this problem, but it’s a political hot potato. Why? To get Social Security back on track, Congress needs to make the unpopular decision to raise taxes. (If you’re seeking reelection, it’s just easier to kick the can down the road to the next person.)

Congress can also look at solutions such as raising the Social Security tax rate or increasing the wage base on income subject to Social Security tax. Or, you may eventually have the option to defer benefits beyond age 70. Ultimately, a small tweak to each of these things would likely create solvency without resulting in cuts to benefits.

For now, though, theoretical solutions may not make you feel any better. Fortunately, we have something that can help. We can use software to run a what-if scenario to determine what your clients’ long-term financial plans would look like if Social Security benefits were reduced—and then we can work together to plan accordingly.

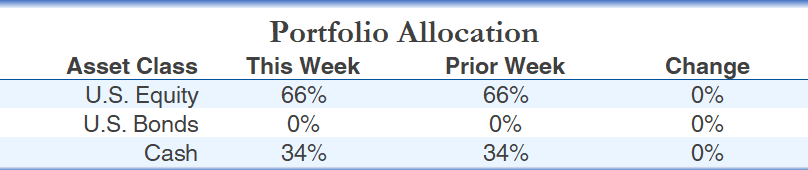

Strategy Activity Update

Please see below for a summary of the trades we executed over the week through Thursday and our current tactical strategy allocations.

Dividend Income

No trades

AIQ Tactical Global Growth

Buy iShares MSCI Switzerland ETF (EWL)

Sell Cash

AIQ Tactical Defensive Growth

No trades

AIQ Tactical Multi-Asset Income

Buy Vanguard Dividend Appreciation ETF (VIG)

Sell iShares TIPS Bond ETF (TIP)

AIQ Tactical High Income

Buy iShares 0-5 Year High Yield Corporate Bond ETF (SHYG)

Buy iShares iBoxx USD High Yield Corporate Bond ETF (HYG)

Sell Cash

If you’d like to learn more about our tactical or fundamental strategies, please contact Steve Johnson at 844-587-7393 or info@advisercapital.com.

Please note: This update was prepared on Thursday, April 20, 2023 prior to the market’s close.

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Purchases and sales of securities listed above represent all securities bought and sold in each strategy during the period stated. Each strategy’s portfolio generally includes more holdings in addition to the transactions listed above and in some cases the securities listed above may only represent a small portion of the particular strategy’s complete portfolio. Further, the securities listed above are not selected for listing based on their investment performance; thus it should not be assumed that any of the securities listed above were profitable or will be profitable, nor should it be assumed that future recommendations will be profitable. Clients and prospective clients should only make judgements about a strategy’s performance after reviewing the strategy’s composite performance information. There is no assurance that each security listed above will remain in the strategy’s portfolio by the time you have received or read this email. Securities are listed for informational purposes and are not intended as recommendations. Existing investor accounts may not participate in all transactions listed above due to each account’s particular circumstances.

Our statements and opinions are subject to change without notice and should be considered only as part of a diversified portfolio. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with Adviser Investments Tax Solutions. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

Third-party publications referenced in this article (e.g., Citywire, Barron’s, InvestmentNews, CNBC, etc.) are independent of Adviser Investments. Readers should note that to the extent any third-party publication linked to in this piece also contains reference to any of the newsletters written by Dan Wiener or Jim Lowell, such references only pertain to the respective newsletter(s) and are not reflective of Adviser Investments’ investment recommendations or portfolio performance. Newsletters are operated independently of Adviser Investments. Opinions and statements contained in third-party articles are for informational purposes only; they are not investment recommendations.

The Adviser You Can Talk To Podcast is a registered trademark of Adviser Investments, LLC.

The Adviser Capital logo is a registered trademark of Adviser Investments, LLC.

© 2023 Adviser Capital, an Adviser Investments, LLC company. All Rights Reserved.