What Is Your Legacy?

Strategy Activity Update

Market & Economy Snapshot

What Is Your Legacy?

Many people begin thinking about their legacy and estate plan around the same time they start seriously considering retirement—perhaps even later. Why wait? At Adviser, legacy planning begins further upstream—ideally as soon as we create your first financial plan. Here are some key questions to help get you started.

What does legacy mean to you? Legacy is about more than just money. Sure, it often entails directing funds to your children or a charity—but there’s more. At its core, your legacy centers on how you want to be remembered. As a business builder? A philanthropist? A parent and spouse? For some people, it’s all of those things. Legacy is, in part, about the values you want to pass along to the next generation. Think about how you want to be remembered, and then make sure your financial plan supports that vision.

Can your legacy begin in your lifetime? Legacy planning is a bit of a misnomer because it isn’t necessarily about what you leave behind. In many cases, you can enjoy your legacy in your lifetime. Some of our clients want to keep their family close, so we discuss funding family vacations. Others hope to see the happiness in the eyes of the person they are helping, so we work with them to structure a charitable fund or a trust that starts giving immediately. Sometimes a person’s legacy is more about leaving the next generation financially secure down the line—they may be uncomfortable giving during their lifetime. Either way, our best guidance is to be intentional in your decision-making to ensure your strategy allows your legacy to unfold on your timeline.

What tools should you use? The idea is to help you create a legacy that delivers on your personal goals in the most tax-efficient manner possible. That may mean setting up a spousal lifetime access trust (SLAT) or a donor-advised fund (DAF)—or more likely a structured combination of strategies. The options (and acronyms) are extensive, but they are by the tools by which you can create an estate plan that meets your needs. At the same time, you can make sure your beneficiary information is updated and all of your estate documents are in place. Here’s much more on estate strategy.

Strategy Activity Update

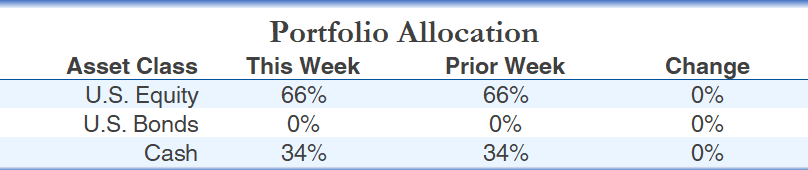

Please see below for a summary of the trades we executed over the week through Thursday and our current tactical strategy allocations.

Dividend Income

No trades

AIQ Tactical Global Growth

Buy Cash

Buy iShares US Medical Devices ETF (IHI)

Sell Fidelity MSCI Communication Services Index ETF (FCOM)

Sell iShares Expanded Tech-Software Sector ETF (IGV)

AIQ Tactical Defensive Growth

No trades

AIQ Tactical Multi-Asset Income

No trades

AIQ Tactical High Income

No trades

Market & Economy Snapshot

A lackluster earnings report Tuesday from shipping giant United Parcel Service and a sizable $100 billion deposits deficit at the troubled First Republic Bank snapped a stretch of market calm, sending the S&P 500 and Dow Jones Industrial Average down more than 1% each Tuesday—a relatively modest decline notable only in that it was the biggest drop for either index in more than a month.

Results were rosier for some of the tech titans that have propelled markets this year: Google parent Alphabet reported on its search business’ resilience (if companies anticipate cost cuts, one of the first items to go is often advertising, Google’s bread and butter). Microsoft’s sales and profits also exceeded expectations with still-robust spending by businesses. All told, the tech sector has put up its best start to a year relative to the S&P 500 since 2009.

More than one-third of S&P 500 companies have reported first-quarter earnings as of Thursday morning, with 81% beating analyst expectations. That’s above a long-term average of 73%. Next week, it’s all eyes on the Federal Reserve’s two-day policy meeting (starting May 2), after which we’ll parse the central bank’s interest-rate-policy announcement and analysis of current economic conditions.

If you’d like to learn more about our tactical or fundamental strategies, please contact Steve Johnson at 844-587-7393 or info@advisercapital.com.

Please note: This update was prepared on Thursday, April 27, 2023 prior to the market’s close.

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Purchases and sales of securities listed above represent all securities bought and sold in each strategy during the period stated. Each strategy’s portfolio generally includes more holdings in addition to the transactions listed above and in some cases the securities listed above may only represent a small portion of the particular strategy’s complete portfolio. Further, the securities listed above are not selected for listing based on their investment performance; thus it should not be assumed that any of the securities listed above were profitable or will be profitable, nor should it be assumed that future recommendations will be profitable. Clients and prospective clients should only make judgements about a strategy’s performance after reviewing the strategy’s composite performance information. There is no assurance that each security listed above will remain in the strategy’s portfolio by the time you have received or read this email. Securities are listed for informational purposes and are not intended as recommendations. Existing investor accounts may not participate in all transactions listed above due to each account’s particular circumstances.

Our statements and opinions are subject to change without notice and should be considered only as part of a diversified portfolio. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with Adviser Investments Tax Solutions. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

Third-party publications referenced in this article (e.g., Citywire, Barron’s, InvestmentNews, CNBC, etc.) are independent of Adviser Investments. Readers should note that to the extent any third-party publication linked to in this piece also contains reference to any of the newsletters written by Dan Wiener or Jim Lowell, such references only pertain to the respective newsletter(s) and are not reflective of Adviser Investments’ investment recommendations or portfolio performance. Newsletters are operated independently of Adviser Investments. Opinions and statements contained in third-party articles are for informational purposes only; they are not investment recommendations.

The Adviser You Can Talk To Podcast is a registered trademark of Adviser Investments, LLC.

The Adviser Capital logo is a registered trademark of Adviser Investments, LLC.

© 2023 Adviser Capital, an Adviser Investments, LLC company. All Rights Reserved.