Debt-Ceiling Drama—Existential or Overblown?

Roth IRA FAQ

Adviser Market Update

Strategy Activity Update

Additional Insights

The Debt-Ceiling Drama—Existential or Overblown?

The din from the debt-ceiling debate is almost deafening, and the two sides in Congress have yet to strike a deal. So, how did we get here and should you be concerned?

Simply put, the U.S. government has two primary sources for money to meet its spending obligations: Taxes and selling bonds like Treasurys (issuing debt). But it can only issue so much debt before it hits the debt ceiling, the limit imposed by Congress. Congress also controls how much the government spends. When our obligations outpace the money raised from taxes and bond issuance, well, something must give.

And so here we are again, beyond the limit on borrowing. And in today’s partisan environment, no one wants to blink first even as a credit default looms large.

But there’s a calming caveat to this situation that bears repetition: We’ve been here before. Since 1960, Congress has raised, extended or refined the definition of the debt limit 78 times—49 times under a Republican administration and 29 times under Democrats. Whenever the debt ceiling comes into view, Congress is called upon to act, and it has ultimately done so 100% of the time—sometimes at the very last minute.

As such, we won’t be making major reactive adjustments to your portfolio or financial plan in response to debt-ceiling posturing and negotiations. As we mentioned in our recent webinar, these types of events come and go like so much other noise. From a financial planning perspective, we are far more interested in the life events that matter to you personally and professionally. Getting married and starting a family. Dealing with health issues. Starting or selling a business. Planning your legacy. These events play more directly into your long-term financial plan, and they are the things we can work with you to prepare for.

Please call us if you are concerned about the debt ceiling or other current issues, and let us know when you experience a life event that could impact your personal wealth development plan. We’re ready to guide you and put all of it into perspective.

Roth IRA FAQ

We spend a lot of time answering your questions about Roth IRAs—and it’s time well spent. As we’ve likely talked about, Roth IRAs have some impressive tax advantages that make them appealing. Ideally this refresher is helpful, but let’s talk if you have questions that we don’t address.

What’s the difference between a Roth IRA and a traditional IRA? The difference comes down to taxes. Traditional IRAs and 401(k) contributions are made pretax—which means you sidestep the tax man (for now), thus lowering your annual taxable income in the year you make contributions. Your earnings grow tax-free, but withdrawals (after age 59½) are taxed as ordinary income. With a Roth IRA, you contribute money that has already been taxed as income. Once invested, your earnings compound tax-free, and there is no tax on qualified withdrawals taken after age 59½.

What is a mega backdoor Roth conversion? A mega backdoor Roth conversion allows you to roll over post-tax funds from a traditional 401(k) into a Roth in certain situations (note that not all 401(k) plans allow mega backdoor conversions). If your retirement is many years down the road, the potential to compound your benefit for years (without having to pay taxes on withdrawals) could be advantageous—especially if you expect to be in a higher tax bracket in the future.

Should you convert from a traditional IRA to a Roth IRA? Here are some of the factors to consider when you’re deciding whether a Roth conversion makes sense for you.

What tax bracket will you be in? Generally, if you have a low-income year (due to early retirement or another reason), it may make sense to convert.

What’s your time frame? The longer you have before you need the money, the more sense it makes to convert to a Roth.

What kind of legacy do you wish to leave? Based on their tax treatment, Roth IRAs are better assets to pass along to your heirs than traditional IRAs.

There’s more, so click here for our handy Roth conversion checklist.

So, should you choose a Roth over a traditional IRA? It really depends on your situation. Both account types offer benefits and drawbacks—your advisor can guide you through your options and help you make the best decision in the context of your overall retirement and legacy plan. As always, call us with any specific questions!

Adviser Market Update

Here are some of the things our research team is watching this week and why they matter:

Can the Fed still pull off a “soft landing?” Policymakers continue to insist that dodging a recession remains possible as long as the job market can maintain strength as inflation slows. Last week’s employment numbers are encouraging: In April, the unemployment rate dropped to 3.4%—back to its lowest level since 1969.

Are rate hikes done (for now)? Inflation, while still historically high, continues to come down—providing the central bank with cover should it decide to pause its rate-hike cycle following last week’s action. Consumer prices were up 4.9% in April compared to the same time last year, marking the first time annualized inflation has fallen under 5% since spring 2021. Markets rallied yesterday on news of the downward trend.

The debt-ceiling drama. The economy, banking sector and financial markets continue to demonstrate stability even as concerns mount that the debt-ceiling battle could cause a disruption in the financial markets. As mentioned above, we think Washington will come through and prevent the U.S. from defaulting, but we’re planning a proper course of action should the situation go south.

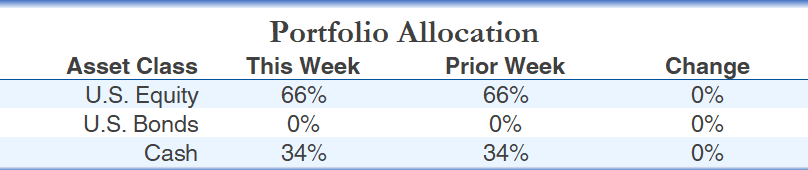

Strategy Activity Update

Please see below for a summary of the trades we executed over the week through Thursday and our current tactical strategy allocations.

Dividend Income

No trades

AIQ Tactical Global Growth

No trades

AIQ Tactical Defensive Growth

No trades

AIQ Tactical Multi-Asset Income

Sell Vanguard Dividend Appreciation ETF (VIG)

Buy iShares J.P. Morgan EM Local Currency Bond ETF (LEMB)

AIQ Tactical High Income

No trades

If you’d like to learn more about our tactical or fundamental strategies, please contact Steve Johnson at 844-587-7393 or info@advisercapital.com.

Please note: This update was prepared on Thursday, May 11, 2023 prior to the market’s close.

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Purchases and sales of securities listed above represent all securities bought and sold in each strategy during the period stated. Each strategy’s portfolio generally includes more holdings in addition to the transactions listed above and in some cases the securities listed above may only represent a small portion of the particular strategy’s complete portfolio. Further, the securities listed above are not selected for listing based on their investment performance; thus it should not be assumed that any of the securities listed above were profitable or will be profitable, nor should it be assumed that future recommendations will be profitable. Clients and prospective clients should only make judgements about a strategy’s performance after reviewing the strategy’s composite performance information. There is no assurance that each security listed above will remain in the strategy’s portfolio by the time you have received or read this email. Securities are listed for informational purposes and are not intended as recommendations. Existing investor accounts may not participate in all transactions listed above due to each account’s particular circumstances.

Our statements and opinions are subject to change without notice and should be considered only as part of a diversified portfolio. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with Adviser Investments Tax Solutions. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

Third-party publications referenced in this article (e.g., Citywire, Barron’s, InvestmentNews, CNBC, etc.) are independent of Adviser Investments. Readers should note that to the extent any third-party publication linked to in this piece also contains reference to any of the newsletters written by Dan Wiener or Jim Lowell, such references only pertain to the respective newsletter(s) and are not reflective of Adviser Investments’ investment recommendations or portfolio performance. Newsletters are operated independently of Adviser Investments. Opinions and statements contained in third-party articles are for informational purposes only; they are not investment recommendations.

The Adviser You Can Talk To Podcast is a registered trademark of Adviser Investments, LLC.

The Adviser Capital logo is a registered trademark of Adviser Investments, LLC.

© 2023 Adviser Capital, an Adviser Investments, LLC company. All Rights Reserved.